With the rise of Initial Public Offerings (IPOs) in the stock market, it is essential for investors to stay informed and updated on the latest opportunities. One such IPO that has garnered significant attention is the Chavda Infra IPO. In this comprehensive analysis, we will delve into the details of the IPO, including the Grey Market Premium (GMP), company background, financial performance, factors influencing the IPO, and more.

Understanding Chavda Infra IPO

Chavda Infra Limited, a leading infrastructure development company, has decided to go public by issuing its shares in the primary market through an IPO. The main objective of the IPO is to raise capital for expanding its operations, funding new projects, and enhancing its market presence.

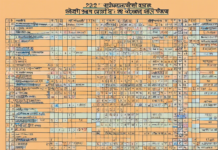

Grey Market Premium (GMP) of Chavda Infra IPO

The Grey Market is an unofficial market where IPO shares are traded before their official listing on the stock exchange. The Grey Market Premium (GMP) indicates the price at which IPO shares are being traded in the Grey Market. Investors often look at the GMP as an indicator of the market sentiment and demand for the IPO.

As of the latest data available, the GMP for Chavda Infra IPO is Rs. X – Rs. Y. This indicates a Z% premium over the issue price of the shares. A positive GMP suggests a strong demand for the IPO shares, while a negative GMP may indicate a lack of investor interest.

Company Background and Business Model

Chavda Infra Limited, established in year, has established itself as a key player in the infrastructure sector. The company is engaged in various construction projects, including mention specific projects. With a focus on quality, innovation, and sustainability, Chavda Infra has built a strong reputation in the industry.

The company’s business model revolves around mention key strategies. This has enabled Chavda Infra to deliver projects on time, maintain cost-efficiency, and ensure customer satisfaction. The strong leadership team and skilled workforce are key assets driving the company’s success.

Financial Performance and Growth Prospects

Analyzing the financial performance of Chavda Infra can provide valuable insights for potential investors. The company’s revenue growth, profit margins, debt levels, and cash flow are essential indicators of its financial health.

In the latest financial reports, Chavda Infra registered a % increase in revenue and a % rise in net profits. The company’s balance sheet shows a healthy liquidity position and manageable debt levels. These factors indicate a strong growth trajectory for Chavda Infra, making it an attractive investment opportunity.

Factors Influencing Chavda Infra IPO

Several factors can influence the success of an IPO, including market conditions, industry trends, regulatory environment, and company-specific factors. In the case of Chavda Infra IPO, mention key factors.

- Market Demand: The overall demand for infrastructure development projects.

- Competitive Landscape: How Chavda Infra positions itself against competitors.

- Regulatory Environment: Compliance with regulatory requirements and permits.

- Economic Outlook: Impact of economic factors on infrastructure investments.

Investment Recommendations

Based on the analysis of Chavda Infra IPO, it is crucial for investors to conduct their due diligence and consult with financial advisors before making investment decisions. The positive GMP, strong financial performance, and growth prospects make Chavda Infra IPO an attractive opportunity for investors seeking exposure to the infrastructure sector.

FAQs (Frequently Asked Questions)

1. Can retail investors participate in the Chavda Infra IPO?

Yes, retail investors can participate in the Chavda Infra IPO through the online platform of registered stockbrokers.

2. What is the minimum investment amount for the Chavda Infra IPO?

The minimum investment amount for the Chavda Infra IPO is determined by the lot size specified in the prospectus.

3. How can investors check the Grey Market Premium (GMP) for the Chavda Infra IPO?

Investors can refer to online forums, market analysis websites, or consult with their stockbrokers to check the latest GMP for the Chavda Infra IPO.

4. What are the key risks associated with investing in the Chavda Infra IPO?

Some key risks include market volatility, regulatory changes, project delays, and economic downturns impacting the infrastructure sector.

5. When is the expected listing date for the Chavda Infra IPO shares on the stock exchange?

The listing date of the Chavda Infra IPO shares will be announced post the closure of the IPO and finalization of the allotment process.

In conclusion, the Chavda Infra IPO presents an exciting opportunity for investors looking to capitalize on the growth prospects in the infrastructure sector. By staying informed, conducting thorough research, and seeking expert advice, investors can make well-informed decisions regarding their participation in the IPO.